London Gold Bait-and-Switch as LBMA Prepares Bigger Changes

In a coordinated development which signals more than meets the eye, the Bank of England and London Bullion Market Association (LBMA) have together moved to begin reporting gold and silver vault holdings data on a 1 month lagged basis instead of the 3 month lagged basis under which they had been previously reporting vault stocks since 2017.

London Vault Reporting – As Clear as Mud

In addition to the Bank of England’s gold vaults in London, LBMA vault reporting applies to commercial precious metals vaults in London operated by the LBMA bullion banks HSBC, JP Morgan and ICBC Standard Bank, and vaults operated by the LBMA security providers Brinks, Malca-Amit, Loomis and G4S.

Under these new vault reporting changes, it for example now means that as of the end of August, the Bank of England and LBMA have reported claimed gold bar holdings in the London vaults for month-end July (a 1-month lag) instead of for month-end May (a 3-month lag).

The LBMA has also made the same reporting change (from a 3-month to a 1-month lag) for Good Delivery silver bar inventories claimed to be in the LBMA London vaults. Note that while the Bank of England London vaults hold gold bars in custody storage for central bank and bullion bank clients, the Bank of England does not store silver, so the silver data reported by the LBMA applies to just the other seven vault operators listed above.

Putting aside for a moment as to why gold and silver vault stocks in London are not already reported at the end of each and every business day as happens in the COMEX precious metals vaults in New York, this London vault reporting change is suspicious in that the reason stated from both the LBMA and Bank of England is that its an altruistic move to improve gold market transparency. Furthermore, both parties claim that they are following a recommendation (for improved transparency) set out in the UK regulators’ Fair and Effective Market Review (FEMR).

The trouble with this claim is that the FEMR’s final report (of which the Bank of England was one of the authors) was published over 5 years ago in June 2015, so the explanation now being pitched by the LBMA and Bank of England is both hard to fathom as difficult to swallow. That card had already been played by the LBMA in 2017 so the real motive is something else.

Convincing the world that the London gold and silver vault inventories are healthy may be part of the strategy, but not in the way you might think. The real agenda in my opinion is to prepare the London vaults for COMEX gold and silver contract delivery by giving a more recent glimpse into vault stocks but without giving COMEX like visibility. How could a one month lag meet COMEX vault approval requirements you might ask? By bending the rules would be the answer. Whether this plays out the way I think it will, we will have to wait and see.

Gold in the Vaults but already Owned

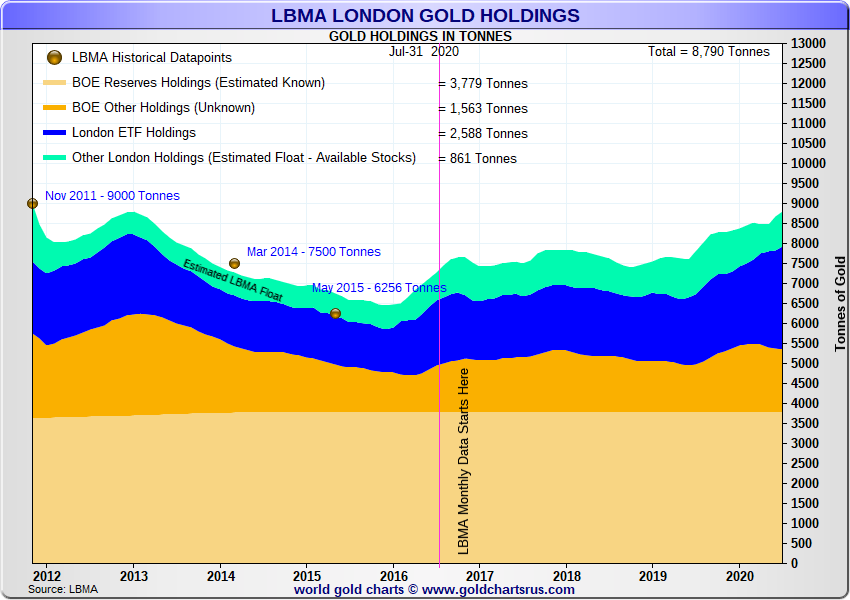

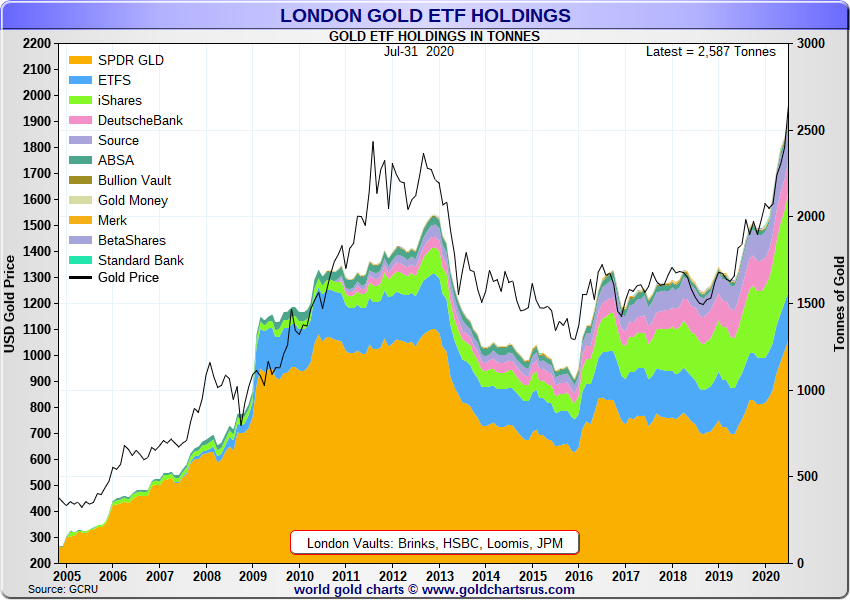

The London gold stocks as of July month-end now total a claimed 8,790 tonnes. Of this total, 5,342 tonnes is claimed to be stored at the Bank of England, meaning that 3,448 tonnes are claimed to be stored in the LBMA London commercial vaults. Subtracting the 2,588 tonnes of ETF gold held in the LBMA London commercial vaults at the end of July, this leaves just 861 tonnes of gold not at the Bank of England and not in ETFs. This 861 tonnes represents gold held by other allocated holders such as institutions, sovereign wealth funds, family offices and ultra high net worth individuals. The bullion banks gold and silver floats then have to compete with these entities to get their fill as well as by raiding GLD and by borrowing gold from central bank clients at the Bank of England.

Singing from the same Song Sheet

According to the Bank of England’s 1 September press release titled “Increased transparency of London gold holdings”:

“The Bank of England will now publish gold holding data with a one-month lag. The reduction from a three-month lag will increase transparency around gold holdings, in line with the Fair and Effective Market Review’s goal to increase transparency in the gold market."

Likewise, in one of its press releases on the matter dated 1 September and identically titled “Increased Transparency of London Gold Holdings”, the LBMA states that:

“In a move towards greater transparency, LBMA, the Bank of England and the commercial vaults announced earlier today that they will now publish the gold and silver holdings of the vaults in London with just a one month lag (instead of the earlier three-month delay)”

Logically, the LBMA can’t shift its reporting lag from 3 months to 1 month without the Bank following suit and vice-versa, as the two entities and their vault reporting are embedded into each other. So when one moves the other has to also.

Bizarrely, in a second press release on the same day, this one titled “Latest LBMA Data – Clearing and Vault data”, the LBMA self-referentially welcomes its own move, stating that “we welcome the announcement to reduce the time lag for publication of London vault holdings”. Since it was the LBMA itself which actually made both the announcement and the data publication change, you can see that corporate spin is alive and well in London.

As well as trying to justify the change based on the FEMR report which was published more than 5 years ago by three of the tentacles of the City of London financial octopus (Bank of England, HM Treasury and Financial Conduct Authority), this sudden ‘Road to Damascus’ impulse by the Bank of England and LBMA to ‘improve transparency’ around London precious metals vault inventories doesn’t cut the mustard because both parties said the exact same thing back in 2017 when first reporting London precious metals vault holdings.

Additionally, as one of the very authors of the FEMR report in 2015, its rich of the Bank of England, five years later, to now claim its reporting change is based on a recommendation it made to itself five years ago.

As a reminder, the Bank of England first published its gold vault holdings data with a 3-month lag at the end of April 2017, at which time the World Gold Council (WGC) praised the Bank as follows:

“Enhanced transparency from the Bank of England

As a leading custodian of gold, with one of the largest vaults in the world, the Bank of England’s decision is highly significant. Not only will it enhance the transparency of the Bank’s own gold operations; it will also support the drive towards greater transparency across the gold market.

The LBMA then followed suit at the end of July 2017, putting out its press release on 31 July 2017 which was humourly titled “Demystifying London’s Gold and Silver Vault Holdings” and in which it stated that:

“These figures provide an important insight into London’s durability and reinforce the underlying strength of the physical OTC Market.”

“LBMA is therefore very pleased to be able to offer this information on a more timely basis”

At that time, the LBMA also quoted FEMR’s recommendation as follows:

“Transparency

According to the Fair and Effective Markets Review …in markets where OTC trading remains the preferred model, authorities and market participants should continue to explore the scope for improving transparency, in ways that also enhance effectiveness.”

Some questions for the Media

Fast forward to today, more than 3 years later, and its déjà vu all over again with the LBMA and Bank of England now going through the same motions, with the exact same language about transparency, and with the exact same claims. This throws up a number of interesting questions such as:

– With the LBMA now trying to claim that the current move to reporting 1 month lagged vault data is in the interests of transparency, this begs the question as to what exactly was the 3 month lagged data, a mere partial demystifying of London’s gold and silver vault holdings?

– Why does the LBMA now feel the need to again “reinforce the underlying strength of the physical OTC Market” by moving to a 1 month reporting lag? Could it be that the underlying strength of the physical OTC market is not so strong?

– Why was this precious metals vault data not provided on a more timely basis over 3 years ago when the LBMA began vault reporting in 2017?

– Why did the FEMR committee not pull up the LBMA and the Bank of England back in 2017 to direct them to report vault data on a 1 month basis instead of on a 3 month lag?

– Why is this move now happening more than 3 years after the initial reporting, and more than 5 years after the FEMR’s final report was published in June 2015?

– Why are the mainstream financial media not asking these simple questions to the Bank of England and the LBMA?

– Why are the mainstream financial media not covering the recent move by COMEX to ‘mass approve’ for COMEX contract delivery, all LBMA gold and silver refiner bar brands, both on the current and former London Good Delivery Lists?

Fair and Effective Markets? Pull the other one

Nor is it wise for the LBMA and the Bank to have raised the word FEMR, for as in the old adage, they should have let sleeping dogs lie. When it was launched in June 2014, the remit of the Fair and Effective Markets Review (FEMR) was to investigate the Fixed Income, Currency and Commodities (FICC) markets in the wake of massive benchmark manipulation scandals that had taken place in LIBOR, in the London Gold Fix, and in Foreign Exchange indexes. Its final report (the FEMR report) published in June 2015 was a summary of these investigations as well as recommendations (recommended with a straight face) to improve market trading standards and to crack down on market abuse.

Hilariously, while one of the outcomes of the FEMR recommendations was the 2017 implementation of the LBMA Global Precious Metals Code, a Code of Conduct which all LBMA members had to sign and commit to, manipulation in the precious metals markets continued apace for years after the FEMR report was published, with LBMA heavy weights such as JP Morgan and Scotia being progressively involved in bigger and bigger gold and silver price manipulations since then. See Scotia misconduct here in 2020 and JP Morgan here in 2019.

The LBMA also had to contend with the embarrassment that one of the LBMA Board members, Michael Nowak of JP Morgan fame, was charged in 2019 by the US Department of Justice (DoJ)for engaging in a racketeering conspiracy under the “Racketeer Influenced and Corrupt Organizations Act, or RICO, as well as other federal crimes in connection with manipulating precious metals futures markets.“

A further outcome of the FEMR report was that the LBMA Gold Price auction (i.e. the re-disguised former London Gold Fix auction launched in March 2015 by the LBMA bullion banks) became a Regulated Benchmark under which manipulation is now a criminal offence. However, this too turns out to have been nothing more than a sham because for example, as recently as last week on 27 August 2020, as the COMEX gold price was being slammed, the afternoon LBMA Gold Price auction took 33 rounds to settle over 21 minutes, while the 12 direct participants (all LBMA members and mainly LBMA bullion banks) collectively first held the bid volume unchanged for 16 rounds, then after round 17 when the price had fallen by $28, then held the ask volume unchanged until round 33. More on that auction in due course.

In the auction, as COMEX price was being slammed, LBMA banks (which control the auction) held bid volume at 73,298 for 16 rounds even as price dropped from $1940.5 to $1912. Bid volume only changed in round 17. LBMA banks then held the ask volume at 108,511 for another 16 rounds. pic.twitter.com/9jFsJmKE2Y

— BullionStar (@BullionStar) August 29, 2020

The Recent London Vault Data

Turning to the most recent vault data now available following the LBMA – Bank reporting change, there is also nothing obvious in the data that would explain a rationale for the Bank and LBMA making move at this time. Granted, the LBMA claims the London gold vault stocks are at an all time high.

However, with most of that gold held by long term holders and at least some of it claimed by multiple parties, a record gold vault stock in itself doesn’t mean much. Changing from a 3-month to a 1-month reporting window for a one hit wonder record claim would be like firing all your ammo for little or no effect. While the new data itself doesn’t justify the change, its worth highlighting all the same.

Before this week’s change, the LBMA and Bank of England would have, at the end of August, been reporting vault holdings as of May month end. With the move to a 1-month reporting lag, the LBMA and Bank of England have now reported three month end vault holdings totals at the same time, up until July month end. from next month they will just report one month’s data with a 1 month lag.

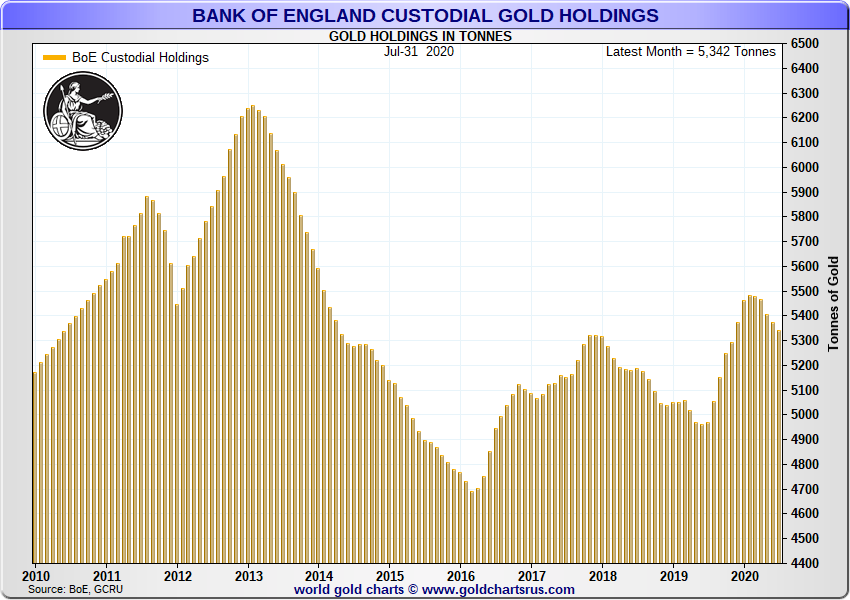

Note that the Bank of England reports its gold vault data separately, while the LBMA vault data figures include all the London vaults, both commercial vaults and the Bank of England vaults. As such the Bank of England data is a subset of the overall totals. Looking first at the Bank of England (BoE) gold vault data, the BoE vaults lost a net 59.9 tonnes in May, lost a net 29.4 tonnes in June, and lost another net 33.1 tonnes in July. In total over the three months from April month-end to July month-end the BoE vaults saw a net outflow of 122.4 tonnes of gold from 5464.4 tonnes at the end of April to 5342 tonnes of gold at the end of July.

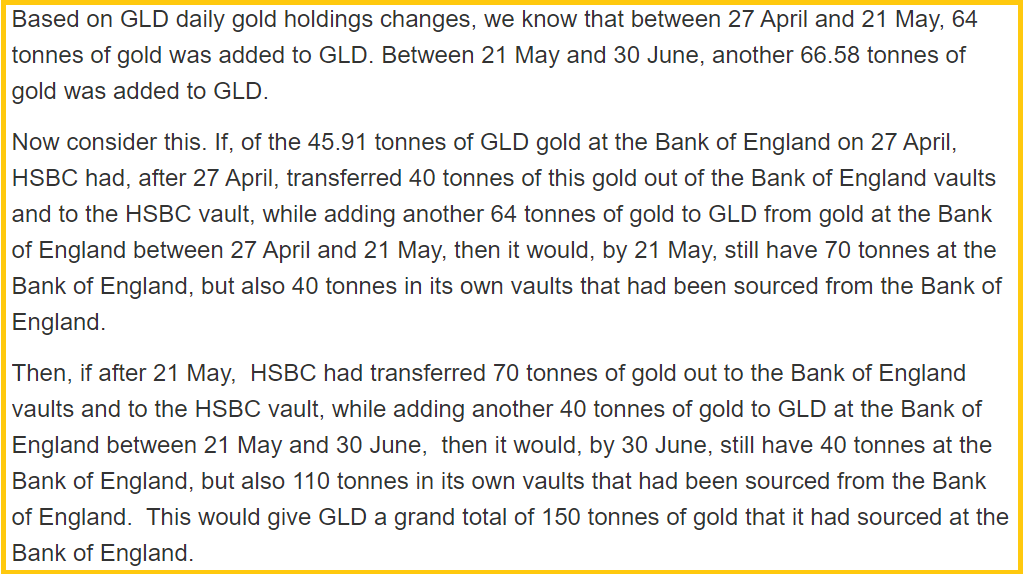

Could this be central bank gold sales or withdrawals from the Bank of England vaults? Possibly. However, the more intriguing possibility is that these outflows are SPDR Gold Trust (GLD) gold bar holdings that had been allocated to the GLD over April to June using the Bank of England as gold sub-custodian, and that over May to July were being transferred out of the Bank of England vaults to the HSBC vault in London. This possibility was covered in the BullionStar article a few weeks ago titled “GLD continues to source gold at the Bank of England, at an escalating rate“.

The reason that this is possible is that using GLD SEC filings and GLD daily gold holdings changes, the SPDR Gold Trust could have transferred out up to 110 tonnes of gold over May and June. GLD was also was also still holding 40 tonnes of gold in the Bank of England at month end. The majority of this too could have been transferred out of the Bank of England vaults in July. For more details see the screenshot below.

Looking at the overall London vault data for gold (including the Bank of England vaults) the overall figure claims a net addition of 308 tonnes of gold between the end of April and the end of July, comprising a net 2.3 tonnes in May, a 184 tonnes net inflow in June, and a 121.7 tonnes net inflow in July.

Given the 122.4 tonnes outflows from the Bank of England vaults over that time, this means that the other vaults (excluding the BoE) together saw a net 430.4 tonnes increase over the May to July period, which comprised 62.2 tonnes in May, 213.3 tonnes in June, and 154.9 tonnes in July.

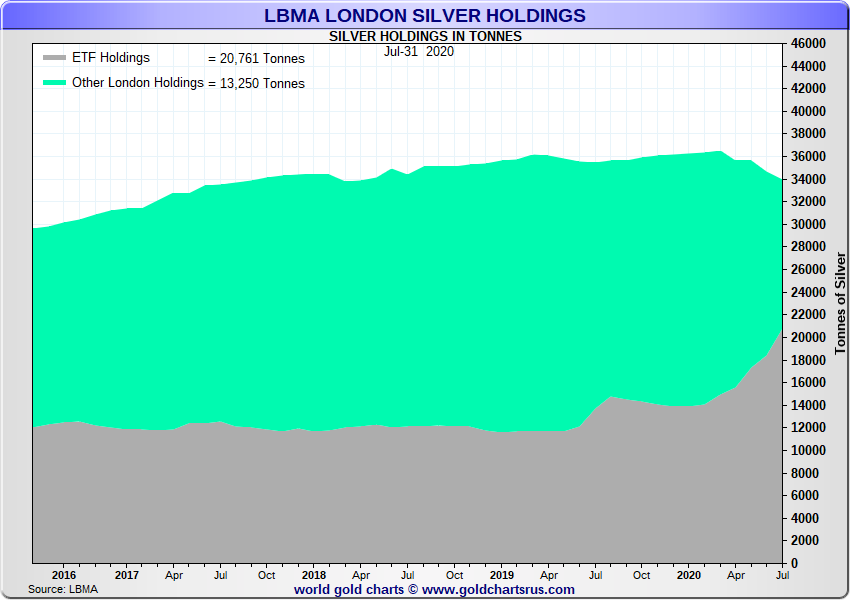

Turning to silver, which is not held at the Bank of England vaults, the LBMA vaults claim that between the end of April and the end of July, the amount of silver held in the London commercial vaults fell from 35,667.8 tonnes to 34,011.9 tonnes, for a net outflow of 1,655.9 tonnes. The bulk of those net silver outflows were in June and July, with the vaults recording a net withdrawal of 915 tonnes of silver in June and 690 tonnes in July, with a residual 51 tonne net outflow in May. With 1600 tonnes of silver leaving the London vaults over June and July, that may be a story for Bloomberg to follow up on.

Conclusion – A More Compelling Reason

On first principles, the LBMA and Bank of England want their vault holdings a) to appear more transparent and b) to create a perception that total metal stocks are deep, and healthy.

But the new claims about transparency and the FEMR report are risible. There is nothing transparent about the London gold and silver markets. Unlike the equity and bond markets, there is no reporting of transactions and trades in the OTC London gold and silver markets. There is no data whatsoever about positions and transactions in the London gold lending market, no data on which commercial banks hold gold accounts at the Bank of England, no data on the identities of central bank gold custody customers of the Bank of England, no data on the size of the enormous unallocated gold and silver liabilities of the bullion banks, no published data on the location of the London commercial vaults, and no published audits of the claimed gold and silver inventories in the LBMA and Bank of England vaults. And that’s just a flavour.

In short, the LBMA bullion banks and Bank of England couldn’t care less gold and silver market transparency. What they do care about though is projecting the illusion of transparency. No more so than when COMEX soon moves to allow gold and silver in the LBMA London vaults to be delivered against the COMEX GC 100 and SI 5000 gold and silver futures contracts.

Last week here I covered the recent move by the COMEX to mass approve all of the gold and silver refiner bar brands of the LBMA (both those on the current and on the former London Good Delivery lists for gold and silver), which is a prelude to facilitating London gold and silver inventories delivery against the COMEX flagship GC 100 oz gold and Si 5000 oz silver futures contarcts . See “LBMA-COMEX collusion intensifies as CME approves 267 LBMA gold and silver bar brands" for details.

As the CME rule wording for the GC 100 contract will probably be when its made: “The depository for gold deliverable against the Gold futures (GC) contract must qualify and be designated a weighmaster and must be located within a 150-mile radius of the City of New York or in London, UK."

Anyone familiar with the approved COMEX vaults in New York and environs will knows that these vaults publish daily end of day inventory totals of the amount of gold and silver held in each of the vaults, e.g. the New York vaults of HSBC, JP Morgan and Brinks.

In early July when highlighting the recently launched COMEX (Enhanced Delivery) 400 oz contract (4GC), which was a trail balloon for London vault delivery, a Bloomberg article spelled out these requirements:

“Exchange rules require vaults to report daily inventory levels even when metal isn’t marked for delivery. “When London vault applications are submitted and approved, they will follow the same guidelines as those of all exchange-approved facilities for metals,” a CME spokesperson said.

…The same rules will apply to storage facilities in London, potentially bringing more transparency if vaults apply to hold inventory backing the contract."

My contention however, is that it’s a bridge too far for the secretive and sensitive LBMA vaults in London (HSBC, JP Morgan, Brinks Radius Park, Malca-Amit etc) to allow daily publications of the amount of gold and silver in these commercial vaults. Powerful holders would not want the veil lifted. Hence, to railroad through the London vault delivery into COMEX contracts, a compromise has been reached between the bullion banks and regulators via upcoming CME and CFTC rule changes. After all, as a Scotia or JP Morgan bullion bank trader might say “Rules are made to be broken".

Thus with this new shift from a 3 month to a 1 month vault reporting lag, the COMEX-LBMA gold pool tag team can, with a bit of spin, hold up a copy of the FEMR report and claim that the London vaults have made a Herculean transparency effort, indeed one that has the blessing of regulators, and successfully ‘lobby’ for a COMEX rule change to allow the London vaults a derogation to only report to COMEX on a 1 month lagged basis instead of the daily end of day requirement of their New York brethren.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments