The Value-Added Tax System In China’s Domestic Gold Market

This post is part of the Chinese Gold Market Essentials series. Click here to go to an overview of all Chinese Gold Market Essentials for a comprehensive understanding of the largest physical gold market globally. This post was updated in 2017.

In the Gold Survey 2016 by Thomson Reuters GFMS there is a complex illegal scheme described whereby criminals obtain VAT invoices from the Shanghai Gold Exchange (SGE) for tax evasion. According to GFMS this scheme is one of the reasons why SGE withdrawals are significantly higher than “Chinese consumer gold demand”. To be able to properly clarify this scheme I will expand in this post on the workings of the VAT system in China’s Gold Market. The scheme has certainly existed for years, but not anywhere near the volume and frequency GFMS portrays.

The Current VAT system in China was adopted in 1994 as part of the economic reform and is often regarded as one of the most complex systems in the world. Here the discussion is simplified somewhat, not to get entangled in details that are not important. Be aware this article does not discuss income tax.

The General VAT System In China

China’s VAT is chargeable on the sale of goods, provision of processing and repair services, and the importation of goods. The standard VAT tax rate is 17 %, a couple of household necessities enjoy a preferential 13 % VAT rate. When visiting any shop or supermarket in China, you will never see any VAT disclosed separately from the unit price. In China it’s common practice to show customers VAT-inclusive prices. In addition, all the prices listed on China’s Commodity Exchanges, the Shanghai Futures Exchange, Dalian Commodity Exchange, Zhenzhou Commodity Exchange and Shanghai Gold Exchange, are VAT-inclusive prices. As a result, if you see a notepad computer priced at 3,510 CNY (onshore renminbi) in China, the VAT is 510 CNY and the VAT-exclusive price is 3,000 CNY.

The “VAT-liable entities” are responsible for collecting the VAT and hand in the money to the tax authority. The VAT-liable entities in China are divided into two categories: general VAT taxpayers and small-scale VAT taxpayers. General VAT taxpayers are large firms that have annual sales large enough and the ability to maintain an accounting system sophisticated enough to accurately calculate output VAT and input VAT. Small-scale VAT taxpayers are firms that don’t satisfy these criteria. Since small-scale VAT taxpayers are not relevant to our discussion, so the focus will be put on general VAT taxpayers.

The formula for computing the VAT payable to the tax authority for a general VAT taxpayer is:

VAT payable = output VAT – input VAT

Output VAT = current period taxable sales * applicable VAT rate

Input VAT = current period costs of eligible purchases * applicable VAT rate

Here is a small example to illustrate VAT computing. Suppose company A is a laptop wholesaler that purchases laptops from Dell, and re-sells them to local retailer B. Company A buys 100 laptops from Dell at the VAT-exclusive unit price of 3,000 CNY. The total VAT-exclusive amount for the goods is 300,000 CNY and total VAT is 51,000 CNY.

VAT-exclusive amount for laptops = 3,000 * 100 = 300,000 CNY

VAT = 3,000 * 100 * 17 % = 51,000 CNY

Dell then issues a VAT invoice on which the 300,000 CNY and 51,000 CNY are recorded.

From Dell’s perspective, the 51,000 CNY is Dell’s output VAT, but from company A’s perspective the 51,000 CNY is its input VAT.

After having bought the laptops from Dell, company A then re-sells them to retailer B at the VAT-exclusive unit price of 4,000 CNY. Implying, the total VAT-exclusive amount for the laptops is 400,000 CNY and the total VAT is 68,000 CNY.

VAT-exclusive amount for laptops = 4,000 * 100 = 400,000 CNY

VAT = 4,000 * 100 * 17 % = 68,000 CNY

Company A then issues to retailer B a VAT invoice on which the 400,000 CNY and 68,000 CNY are recorded. From company A’s perspective, the 68,000 CNY is its output VAT but from retailer B’s perspective the 68,000 CNY is its input VAT.

At the end of the month, the VAT payable by company A is 17,000 CNY, which is to be paid to the tax authority.

VAT payable by company A = output VAT – input VAT = 68,000 – 51,000 = 17, 000 CNY

Company A has to keep Dell’s VAT invoice safe and demonstrate the invoice to the tax authority. If company A couldn’t produce Dell’s invoice to the tax authority, then the 51,000 CNY wouldn’t be allowed to be deducted and company A would have to pay the tax authority 68,000 CNY.

They are four kinds of receipts and invoices in China we will discuss:

- Special VAT invoice (SVI)

- Customs office special receipt for the payment of import VAT

- General VAT invoice

- Shanghai Gold Exchange invoice (SGE invoice)

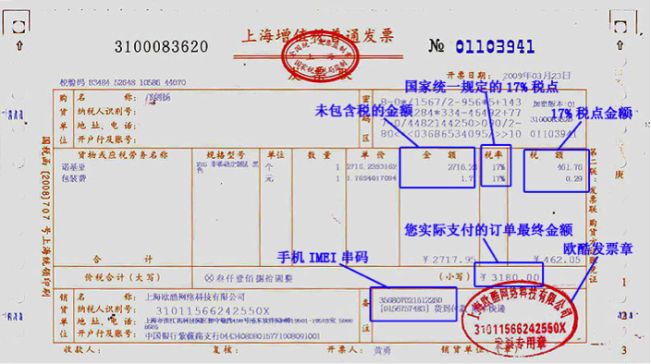

1. Special VAT invoice (SVI). In order for input VAT to be used as a tax credit to offset the output VAT, the input VAT must be substantiated by a “special VAT invoice” (SVI) or “customs office special receipt for the payment of import VAT”. SVIs are issued when a general VAT taxpayer sells taxable goods and services. General VAT taxpayers must purchase blank SVIs from the tax bureau. In China, entities can’t produce any VAT invoice of their own – or it will be fake – but all transaction need to be recorded through an invoice. An SVI looks like this:

2. Customs office special receipt for the payment of import VAT. A “customs office special receipt for the payment of import VAT” is used for imported goods. Suppose company A buys a computer from Australia at the price 10,000 CNY, assuming no tariffs. The exporter in Australia can never give company A a Chinese SVI, but the imported computer does enjoy VAT. Therefore company A must pay the Chinese Customs Office 1,700 CNY (10,000 CNY * 17 %). Upon receiving the money, the Chinese customs office will issue a “customs office special receipt for the payment of import VAT”. With this special receipt, company A can obtain the tax credit (input VAT) from the imported computer.

3. General VAT invoice. A general VAT invoice looks like this:

A general VAT invoice looks very similar to an SVI, though a general VAT invoice cannot be used in obtaining VAT credits when calculating payable VAT. In other words, if you declare to the tax authority that you have 1,000 CNY input VAT but can only produce a general VAT invoice to substantiate your declaration, the tax authority will not recognize the invoice. General VAT invoices are issued by general VAT taxpayers strictly for accounting purposes when they make sales to consumers that will not use the purchase for input VAT. Effectively, general VAT taxpayers issue SVIs for sales to other general VAT taxpayers, and general VAT invoices for sales to consumers.

4. Shanghai Gold Exchange invoice (SGE invoice). The “Shanghai Gold Exchange invoice”, or SGE invoice, is designed by the Shanghai Gold Exchange under the supervision of the national tax authority. It’s a pity I can’t find an image of a SGE invoice.

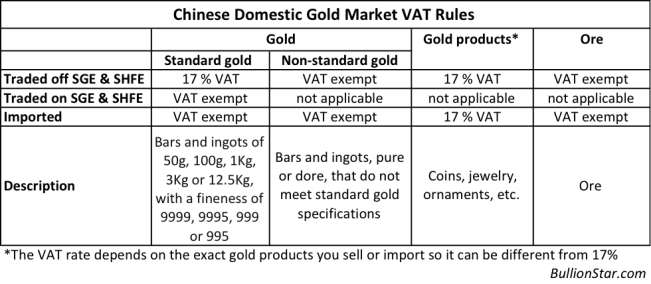

VAT Policy For Gold In China

In China, gold is divided in several categories. There are gold, gold products and ore, and gold is subdivided in standard gold and non-standard. Gold is unwrought/unforged gold, like bars and ingots (HS code 7108120000 and 7108200000). Standard gold refers to gold bars or ingots having a fineness of 9999, 9995, 999 or 995, and a weight of 50g, 100g, 1kg, 3kg or 12.5kg. On the Shanghai Gold Exchange and the Shanghai Futures Exchange (SHFE) only standard gold can be traded. Non-standard gold includes any gold that doesn’t satisfy standard gold criteria, in example 200g ingots. Gold products mean semi-finished gold and finished products of gold, like coins, jewelry and ornaments.

When gold producers and gold traders (general VAT taxpayers and small scale VAT payers) sell non-standard gold off-SGE the VAT is exempt. Gold imported into the domestic market (non-standard and standard gold), for the ones that have an import license, is also VAT exempt.

If standard gold is not sold through the Shanghai Gold Exchange (or Shanghai Futures Exchange), a 17 % VAT tax rate will apply. If standard gold is sold through the Shanghai Gold Exchange (or the Shanghai Futures Exchange), then the VAT is exempt. But it’s the invoicing procedure that is quite complex. An example will follow to illustrate the whole process.

Let’s tie everything together. Suppose the following trades occur. ICBC imports 1 kg of Au99.99 (SGE 1 Kg 9999 gold ingot), which is standard gold, from Switzerland at the price of 230 CNY/gramme (around 1,033 USD/oz). ICBC then sells the gold on the SGE at the price of 234 CNY/gramme. Jewelry manufacturer Laofengxiang is on the other side of the trade. Laofengxiang then withdraws the gold, makes it into gold ornaments, and sells all of them to a retailer at the VAT-exclusive price of 300 CNY/gramme. The VAT payable and receipts and invoices of different parties are as follows:

ICBC

When ICBC imports the gold, it receives a “customs office special receipt for the payment of import VAT”. On this receipt the total VAT-exclusive amount for the gold is 230,000 CNY and the VAT is 0 (ICBC’s input VAT), because imported standard gold is VAT exempt. When ICBC sells the gold at the price of 234 CNY/gramme on the SGE, it needs to issue to the SGE a general VAT invoice, on which it’s recorded 234,000 CNY for the gold and 0 VAT (ICBC’s output VAT), because selling standard gold on the SGE is also exempt from VAT. Upon issuing the general VAT invoice, ICBC will receive an SGE invoice from the exchange.

ICBC VAT payable = output VAT – input VAT = 0 – 0 = 0

SGE

After ICBC and Laofengxiang have concluded the deal, the SGE will issue both ICBC and Laofengxiang an SGE invoice respectively. After Laofengxiang withdraws the gold from the vault, the tax authority will issue a SVI on behalf of the SGE, which the SGE distributes to Laofengxiang. On the SVI, the total VAT-exclusive amount for gold is 200,000 CNY and the amount of VAT is 34,000 CNY. The tax authority decides these two numbers using the following formula:

The total VAT-exclusive amount for gold on the SVI = SGE transaction price * quantity / (1+17%) * 100 % = 234 * 1,000 / (1+17%) * 100% = 200,000 CNY

The VAT amount for gold on the SVI = SGE transaction price * quantity / (1+17%) * 17 % = 234 * 1,000 /(1+17%)* 17 % = 34,000 CNY

To understand the reasoning behind this calculation, please note that after withdrawing the metal, this standard gold leaves a VAT exempt environment (the SGE system), for an environment that is not exempt from VAT, and hence VAT is born into existence. When Laofengxiang doesn’t withdraw the gold, the SGE invoice is the only invoice it will receive for accounting purposes – Laofengxiang needs some evidence for accounting entries. If it withdraws the gold, then it will receive an SVI because the standard gold withdrawn can be manufactured into new gold products and sold off-SGE. Therefore Laofengxiang will need to claim input VAT. General VAT taxpayers that withdraw will get a SVI, individuals that withdraw from the SGE will not. The input VAT noted on Laofengxiang’s SVI from the SGE is not an amount Laofengxiang paid to ICBC as VAT, but Laofengxiang is allowed to deduct this amount from its output VAT.

Laofengxiang

As mentioned, after concluding the purchase of 1kg 9999 gold on the SGE at the price of 234 CNY/gramme, Laofengxiang receives an SGE invoice and also an SVI after it withdraws the gold. The input VAT is 34,000 CNY, which is described above. Laofengxiang then fabricates and sells all the gold ornaments made from the 1kg of gold at the VAT-exclusive price of 300 CNY/gramme. Therefore the output VAT is 51,000 CNY.

Output VAT = ornaments sales price * quantity * 17 % = 300 * 1,000 * 17 % = 51,000 CNY

VAT payable = output VAT – input VAT = 51,000 – 34, 000 = 17,000 CNY

Therefore, the VAT payable for Laofengxiang is 17,000 CNY. Since Laofengxiang has the SVI from the SGE, the tax authority will accept the 34,000 CNY input VAT as a tax credit to deduct from the output VAT.

Up till now, readers will have a general idea on how the VAT system works in China’s gold market.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen