Reuters Spreads False Info On Chinese Gold Lease Market

A reporter from Reuters asserts there is 2,000 tonnes of gold tied up in the Chinese gold lease market. Once again, we will debunk these fictitious statements.

Kindly be advised to have read Mechanics Of The Chinese Domestic Gold Market and Chinese Gold Trade Rules And Financing Deals Explained before you continue. (More in depth information on the Chinese gold lease market can be read in my posts: A Close Look At The Chinese Gold Lease Market, Gold Chat About The Chinese Gold Lease Market, Zooming In On The Chinese Gold Lease Market and Chinese Gold Leasing Not What It Seems.)

The most important event in the current international gold market are the thousands of tonnes being imported into China but are not measured by any Western consultancy firm as demand. The firms have tried to create al sorts of excuses to explain where this missing gold went, but nearly all have proven to be false. For the record, naturally this gold can’t be missing, in my view most of it is simply bought by individual and institutional investors directly at the Shanghai Gold Exchange.

Last month at the LBMA conference a group of ‘gold experts’ discussed how round tripping and gold leasing should explain the difference between withdrawals from the vaults of the Shanghai Gold Exchange (SGE) and Chinese consumer gold demand – the difference refers to the missing gold. However, round tripping and gold leasing can never have soaked up 2,500 tonnes of gold. To debunk this nonsense BullionStar decided to translate the official Chinese gold cross-border trade rules, covering the Chinese domestic gold market and Chinese Customs Specially Supervised Areas, to support an extensive blog post I wrote about round tripping that cannot inflate SGE withdrawals and thus has nothing to do with the missing gold. On 16 November 2015 I published another post about the difference, no I will not stop writing about this, in which I wrote:

… Does the mainstream media ever investigate this odd discrepancy? … Please, show me how gold leasing has inflated SGE withdrawals by 2,500 tonnes …

(“this odd discrepancy” is the difference)

My prayers have been heard! Reuters published an article on 19 November 2015 titled Cracks appear in China’s gold leasing trade as jewelers suffer defaults that asserts there is 2,000 tonnes of gold tied up in the Chinese gold lease market. What a coincidence. Note, the article is only about gold leasing, they dropped round tripping. This Reuters article, published by a mainstream news agency read by thousands of gold investors as their primary source for what’s happening in the international gold market, is truly amazing in being inaccurate. The content can be summarized as:

- There is 2,000 tonnes of physical gold in China tied up in gold leasing,

- currently sales of jewelry is going down and can trigger a cascade of defaults in gold leases, which will subsequently dampen Chinese gold imports and impact Chinese bank balance sheets.

- The outlook is grim.

Needless to say, I disagree and I need to counter such articles in detail – or no one will – because the false assumptions about the Chinese gold market in the mainstream media keep aggregating and spiralling away from any sense of logic.

Reuters can have a habit of exaggerating microscopic events in the Asian gold market to conclude demand is declining. On 12 September 2014 they wrote the Indian population could be abandoning gold altogether as they shifted to put their savings at the bank. The headline read:

India’s love affair with gold may be over

In the body it continued:

Kiran Laxman Salunkhe used to buy jewellery during religious festivals, but sliding gold prices have led the young farmer to break with his family’s traditional investment.

This year Salunkhe has deposited his hard-earned savings at the bank for the first time in a decade…

…”Nowadays it is risky to keep jewellery. Burglaries are rising,” he said. “With a fixed deposit there is no risk.”

In short, Reuters asserted India’s love affair with gold, that goes back thousands of years, might be over because one farmer said to have deposited a few rupees at the bank (there are 1.2 billion people living in India). Of course, a year later India’s love affair with gold is not over and demand is actually on the rise. Year to date (up until August) India has imported 666 tonnes of gold, up 69 % year on year, according to official data from India’s Directorate General of Commercial Intelligence and Statistics. In addition, India’s long awaited gold monetization scheme, pushed by the World Gold Council to dampen India’s gold import, has so far attracted only 400 grams out of the +20,000 tonnes national hoard.

Back to China. Last year, on 15 April 2014, Reuters headlined:

China may have 1,000 tonnes of gold tied in financing

This false assumption was copied from a World Gold Council report (China’s Gold Market Progress And Prospects, April, 2014) that initiated the ‘there are thousands of tonnes of gold tied up in Chinese financing deals’ meme. The meme threats that an unwind (or default) of the financing deals will trigger a collapse in the Chinese gold market and imports would come to a halt, with all due consequences for the international gold market. In the Reuters article from 15 April last year we could read [brackets adde by me]:

“If that number [1,000 tonnes tied up in financing deals] is accurate, it is significant because an unwind of that is equivalent to a year’s worth of (Chinese) imports,"

Guess what, in 2014 China imported roughly 1,250 tonnes of gold and in 2015 China is set to import 1,400 tonnes of gold. Concluding the Chinese gold market has not collapsed, but is gathering steam. So what should Reuters write to defend the meme? There is now 2,000 tonnes tied up in financing deals and any unwind would mean an even greater collapse of the Chinese gold market! Let us analyze the Reuters article from 19 November to understand why it’s false. There was no 1,000 tonnes tied up in gold leasing in 2013, just like there is not 2,000 tonnes tied up in gold leasing now. From Reuters:

The top four Chinese banks alone have up to 443.4 billion yuan ($69.63 billion) tied up in gold leasing, so any pull back could cut China’s imports and hit global bullion prices that are already languishing at the lowest in more than five years.

… Nearly all is likely tied up in gold financing and at current prices would amount to around 2,000 tonnes of bullion.

First of all, the 443.4 billion yuan Reuters bring forward as what Chinese banks show on their balance sheets as ‘precious metals’ can be anything, they are not solely gold leases. This is best elucidated by the annual reports from the banks themselves. Before we read the annual reports, remember, all Chinese banks’ balance sheets merely show ‘precious metals’ assets and liabilities, not any gold, silver or specified items. Furthermore, any Chinese citizen can open an SGE account through a commercial bank or start a gold savings program at a commercial bank. These banks have been the designated vehicles appointed by the State Council to facilitate gold buying for the citizenry and corporations at the SGE – or invest in a bank precious metal product. All of this gold can show up on the bank balance sheets.

From Agricultural Bank of China:

… Precious metals

Precious metals comprise gold, silver and other precious metals.

… As a major precious metal market maker in the PRC, the Bank provided customers with precious metal trading, investment and hedging services through leasing gold, trading of precious metal derivative to customers and trading physical precious metal in the Shanghai Gold Exchange, the Shanghai Futures Exchange and the London precious metals market.

In 2014, … the number of customers with the Account Precious Metals totalled 16,103,300. The Bank proactively explored Precious Metals Trading (Shanghai Gold Exchange) Agency business and the number of contracted customers of Individual Precious Metals Trading (Shanghai Gold Exchange) Agency business amounted to 2,160,700. It introduced innovative products including silver leasing for enterprises and PC client for Individual Precious Metals Trading (Shanghai Gold Exchange) Agency business.

With respect to investment and financial market business, the Bank introduced innovative products such as sales of physical precious metals to corporates…

The Group entered into various derivative financial instruments relating to … precious metals and other commodities for trading, hedging, asset and liability management and on behalf of customers.

Reuters insinuates all ‘precious metals’ in the books of the Chinese banks, worth 443.4 billion yuan, are gold leases but this is absolutely not true. Only the Chinese banks themselves know the exact composition of the ‘precious metals’ in their books. I have yet to meet an outside analyst that knows too. For sure the bank balance sheets capture gold leases, but also other precious metals like silver and a very wide variety of precious metals products for individual clients and corporations (China Construction Bank has 16,103,300 customers with the Account Precious Metals and 2,160,700 customers with the Individual SGE Precious Metals Trading Agency business). Precious metals in the banks’ books can even be gold hold for hedging purposes stored in London. Maybe all the physical gold stored in SGE designated vaults is also shown on the commercial bank balance sheets. We simply don’t know, although we do know it’s not all gold leasing. So, there goes another assumption from Reuters.

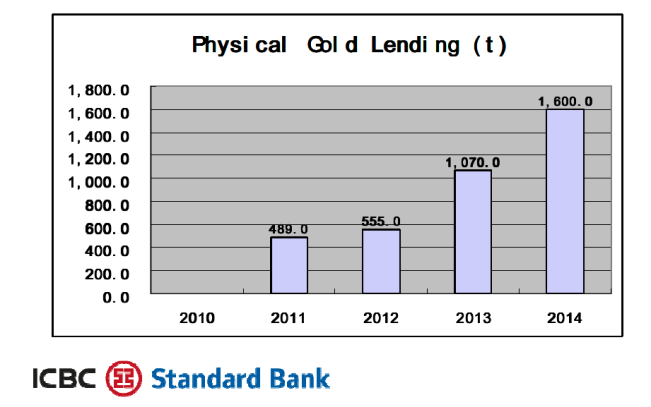

Allow me to share a few more thoughts, about two very scary words used by Reuters: “tied up”. This can sound as if the gold can be untied any moment flooding the Chinese gold market. I think Reuters is mixing up separate data points from the Chinese gold market. In 2014 it was said by the World Gold Council there was 1,000 tonnes of gold tied up in financing deals based on the total lease volume in China, which was 1,070 tonnes in 2013. However, this yearly lease volume is not the gold that is leased out at any point in time, but reflects the aggregated volume disclosed on all lease contracts that are executed over one year’s time in the Chinese domestic gold market. Meaning, if 500 mining companies lease 2 tonnes of gold for 1 month in 2016, the yearly lease volume would be 1,000 tonnes, while on 31 December 2016 the total amount of gold leased out could be nil.

As the yearly lease volume has kept rising since 2013 it could have been Reuters mistakenly matched the yearly lease volume (from a slide by ICBC) to the balance sheets of commercial banks as the gold tied up in gold leasing. Though, the yearly lease volume is not the amount of gold leased out at any point in time and the precious metals in the books of the banks do not merely stand for gold leases. So, we know there is a lot less than 2,000 tonnes of gold on lease in China – say, a few hundred tonnes at max.

Reuters states the 2,000 tonnes (which in reality is a lot less) is tied up in gold leasing. These two words are highly misleading in my humble opinion. In the context of this blog post two types of lessees borrow gold: jewelry companies to manufacture jewelry and enterprises that are seeking cheap credit (mining companies or speculators). The latter will promptly sell spot any borrowed gold to use the proceeds for investment – this gold will not leave the SGE system. In my view, during such a lease period there is nothing tied up in gold leasing; there is just a debt to be repaid by the lessee to the lessor when the lease comes due. At the end of the lease period the lessee has to buy gold in the market (SGE) to settle the debt. In case jewelry companies lease gold the words tied up are more appropriate, in my view, as the leased gold bars are in transit from being processed to being sold as jewelry. But, a jewelry company will always keep its gold inventory as low as possible, which makes me wonder how much gold can be tied up by jewelry companies. In any case, it can only be a share of the total amount of gold leased out in any point in time. Because we all agree most leases in China are used for financing, which requires borrowed gold to be sold spot and bought back when the lease comes due, likely there is only a small percentage of total leases tied up by jewelry companies.

The article by Reuters is centered on declining jewelry sales in China that will lead to defaults in the leases. A few small gold loans have already defaulted, “according to sources familiar with matter”, Reuters wrote. This might be true, but it can also be false.

I haven’t heard any news from China jewelry sales are high this year, so this would imply they are low. However, the most recent numbers from the World Gold Council are hard to be trusted as they are often revised upwards after a few months.

- At first the WGC reported Chinese jewelry sales in 2013 were 669 tonnes, a few months later they revised this number to 928 tonnes, up 39 %.

- At first the WGC reported jewelry sales in 2014 were 624 tonnes, a few months later they revised this number to 807 tonnes, up 29 %.

- Currently the WGC reports jewelry sales Q1-Q3 2015 were 583 tonnes (annualized 778 tonnes), but I guess we have to wait a year before they make their last revision.

Pretty smart from the WGC; when Chinese gold demand numbers are first published, and the gold space is paying attention, they state Chinese demand is low, which greatly influences global sentiment. Months later, when the gold space isn’t paying attention, they revise the numbers to more realistic levels.

I shall rest here. If more Chinese jewelry companies will default in the future we shall see. In any case it will not turn sour 2,000 tonnes of gold tied up in gold leases.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen