Professor Yu Yongding On Gold

Professor Yu Yongding is, in short, an Academician of the Chinese Academy of Social Sciences (CASS), Editor-in-Chief, China and World Economy (1998- ), Member of Advisory Committee of National Planning of the National Development and Reform Committee of the PRC (2004- ), Member of Advisory Committee of Foreign Policy of the Ministry of Foreign Affairs of the PRC (2010- ), and he was, inter alia, Member of the Monetary Policy Committee of People’s Bank of China (2004-2006) and President of China Society of World Economy (2003-2011).

Let’s take a look at his opinion on gold.

As a member of the Monetary Policy Committee of the PBOC in 2006 he said:

China has more than enough foreign-exchange reserves. While they cannot be reduced sharply all at once, China has decided to take measures to curb their growth rate and diversify investment of its reserves. ..We don’t want to cause dramatic fluctuations in the foreign-exchange and securities markets.

China needs to establish a separate body to oversee and invest the reserves to seek higher returns and to avoid losses in case of a big depreciation in the U.S. dollar. ..We need to use some of the reserves to buy other assets such as gold and strategic resources such as oil.

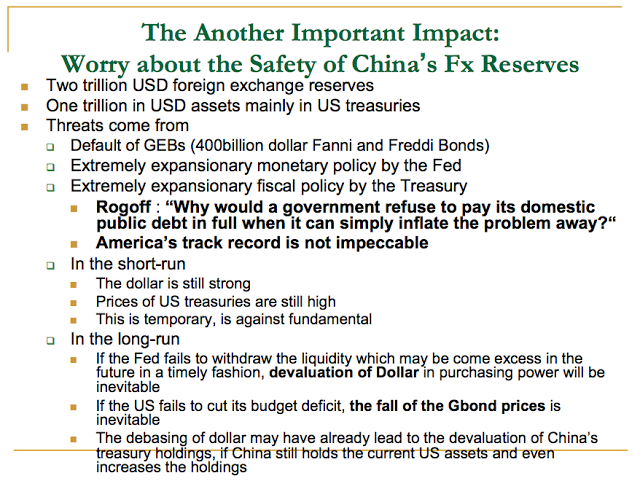

..devaluation of Dollar in purchasing power will be inevitable.

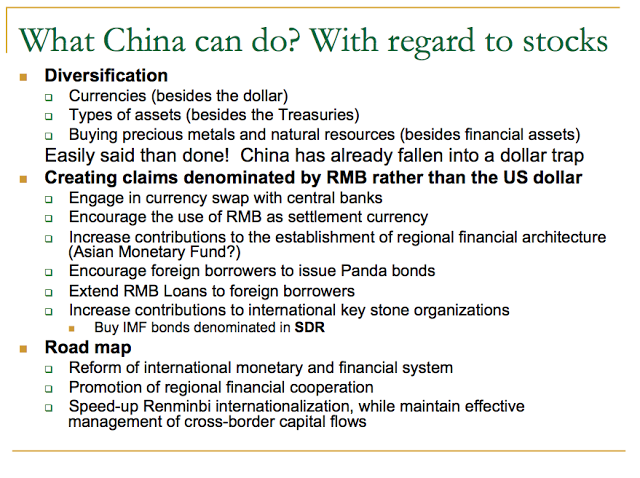

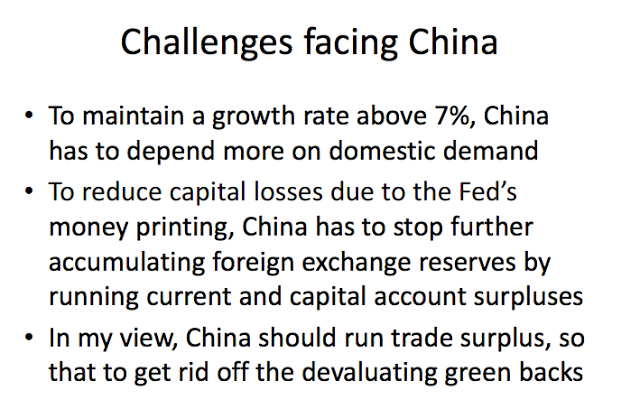

What can China do? Buying precious metals and natural resources (besides financial assets). Easily said than done! China has already fallen into a dollar trap.

Due to China’s huge forex reserves, it’s difficult in the short term to make gold a main channel to accumulate forex reserves like the US and European countries have accumulated. It’s especially true that as global gold prices make new highs, increasing gold reserves also becomes more difficult.

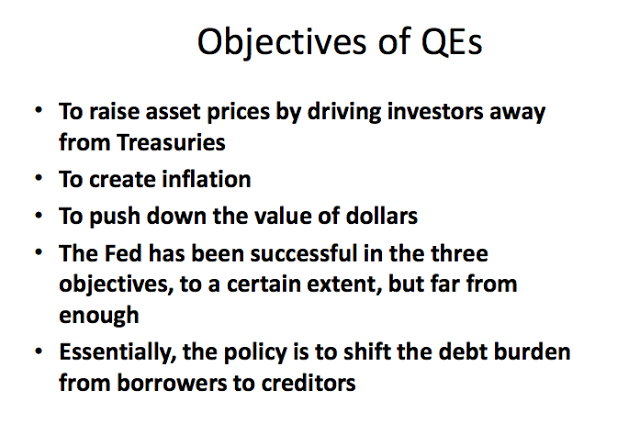

QE objectives:

….

– To create inflation. Before taking over the Presidency of the Fed, Bernanke was very open in talking about the possibility of using inflation to solve the debt problem. He gained the very apt nickname ‘Helicopter Ben’, and I think he will rule out this option, but of course he will not say so openly.

– To push down the value of the dollar is another very important objective of QE, even though Bernanke refused to admit that this is the policy, but I think Greenspan is more honest, because he is no longer the governor.

Essentially, the policy of QE is to shift the debt burden away from borrowers at the expense of creditors and I think this is basically the situation that China is facing.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen