Guest Post: Spelling Out the Big Reset

Written by LK in Hong Kong

As economies age, debt builds up. Advanced economies – those with the highest borrowing ratings by the reputable agencies they developed – have it clogging up inside all their arteries. The Big Reset will finally become inevitable, as has been acknowledged by the IMF head Largarde, mentioning the year 2020. But what must an Armageddon debt reset necessarily involve? Few have spelled it out, not even in the famous book with the same title “The Big Reset" by Willem Middelkoop.

Revision on money creation mechanics: unwrapping the meaning of ‘Reserves’

At the center of it all, wrapped by layers of secrecy and protected on the outside by purposefully confusing jargons is this concept of Reserves. Let’s understand it to mean ‘net worth’, ‘collateral’, or whatever a banking entity’s ‘really worth’, because what banking entities do, is to use this asset as backing to create instruments and derivatives, like loans, or even money, and expand the money supply. In long tradition, the ultimate reserve asset is of course gold. When the bank’s (or central bank’s) worthiness comes into doubt (like to many gold-deposit receipts flying around), people come for the ‘reserves’. If the reserves satisfy the claims, then it’s good.

In our fiat currency world since 1971, countries hold each other’s currencies as legitimate reserves. The country’s central bank can then go create the country’s own currency. The justification is simple: there is this unsaid assumption that when the worthiness of a country’s money becomes in doubt, one would not question the worthiness of the other currencies held as reserves, and, hence, as long as the country’s central bank can supply the ‘safe’ reserve currency to meet with the country’s currency being sold, all is well. As we approach it from this angle, we know to ask the question, “what then gives the other reserve currencies their value?" Note, this process enables country A to expand the money aggregate in foreign country B also, if only country B is happy to have currency A in its reserve to create some more currency B at will.

Money creation is a happy process. Everyone likes it, from businesses to banks to governments to the everyday wage earner who is happier even if his salary only rises by the same amount as inflation. And this is so even for our debt-money system, in which money is very much ‘loaned into existence’ as a debt is created. The temptation is strong, and this is fundamental.

As the Devil has it, there are two issues with this that are necessary consequences:

(1) With debt comes interest, and if one keeps expanding the borrowing, one day the interest requirement will exceed earning power, and this is where the ‘advanced economies’ are today.

(2) If the money supply grows faster than the amount of goods and services it can be traded for, this leads to inflation. It is important to have people believe that their money is good so they do not have the tendency to convert their money into real assets. Hyperinflation is the currency event in which faith is lost in money and when people rush to buy real assets, they find that there is not anywhere near enough physical assets to satisfy money claims.

Looping back to the concept of reserves, the central idea to a stable banking system is to have people believe that the reserve of the system is good – in sufficient quantity as an ‘end product’.

The Sure-fire way to Reset

Now, our ‘advanced economies’ have already passed the point where interest service is manageable. In an effort to perpetuate the illusion for as long as possible before stage (2) when the quality of the debt papers is called into question, our money masters have launched outright money printing to maintain service of debt interests. They cranked up the power of their mind-influencing machines, and will do “whatever it takes" to avoid their game being called. Clearly this can only exacerbate the onset of Stage (2).

“The Fed’s balance sheet is a pile of tinder, but it hasn’t been lit … inflation will eventually have to rise.”

– Alan Greenspan 25 October 2014, New Orleans Investment Conference.

The problem of a debt reset is not the wiping-out of creditors, but the destruction of currencies together with it. Without currencies, the economy cannot function with any efficiency.

Hence the sure-fire way to reset is to use an indestructible material that exists in fixed, limited quantity to act as reserve asset for money. Gold naturally fulfills this role in any and all precedent failure instances of money and it will work again. Once enacted however, liquidity condition will once again face hard constraint by the physical substance available. Any money printing will translate into a loss of value of each currency unit. Against a strict liquidity condition, life will be much tougher! But it will work.

One step short but keeping the benefits: the SDR?

International monetary expert Jim Rickards has a helpful way to visualize the evolution of financial crises in the West. He explains that every time a crisis breaks out, it is bailed out by the next bigger entity assuming the obligations, “kicked one level upstairs", in order to avoid a default situation blowing a monetary hole threatening stability. For example, LTCM was bailed out by the banks. When banks get into systemic trouble, they’re bailed out by central banks and sovereigns. What now is the next level up above sovereigns? There isn’t any clear one.

One attempt at this short of going directly to gold might be the Special Drawing Rights of the IMF, claiming to be the super-national authority in charge. The SDR is by design and by hope a reserve asset. It only came to have this funny name by concession to the French in 1969 who did not want it called a reserve asset. As we now understand the nature of reserves, we know it has been the purpose and hope of its creators that when the whistle on fiat currencies blows, people can be convinced to accept this as having value, just because it appears to be issued and controlled by a cross-national group of men in suits. SDR would then be endowed upon obeying nations to be used for ‘good’ money creation. But what is the SDR? It is still a basket of the same fiat currencies.

So, we already see that this might only be the dream of hopeful men in suits and probably won’t work when it is most needed. Enter China and the RMB. The two questions are now:

a) Why does it have a better chance of working, and

b) What does China want?

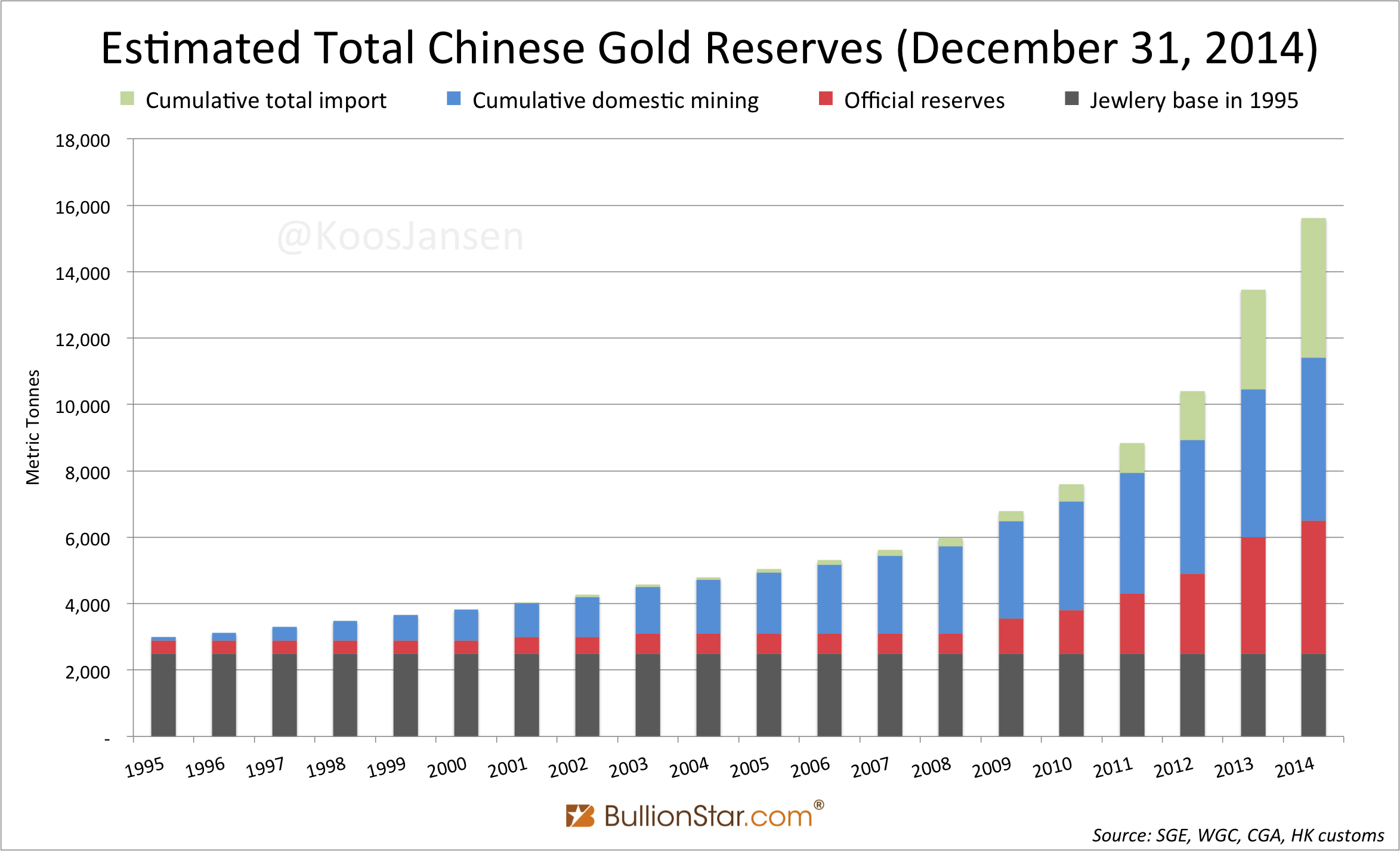

The answer to a) is, as to what is different now, is that unlike the ‘advanced economies’, China is a creditor nation, and the World’s largest one. If it says okay, it probably is okay a long way already. Plus, China has imported a lot of gold, so it could make references to the gold anchor in ways that are helpful to its aims. By this chart, the gold content within China’s borders is more like 16,000 tonnes, twice as large as the largest official stockpile claimed by any single country (USA).

What can China want? By inclusion as a crucial component in the SDR, China gets a control on this international reserve asset, and by deduction, world money supply. The use of reserves is to legitimize money creation. Here is that immortal quote again from the very MA Rothschild himself:

“Give me control of a nation’s money supply, and I care not who make its laws"

It certainly is a very powerful position, although whether China has the ambition to rule the world this way is a different issue. But it is a more flexible possibility than the strict, full gold-fixed gold-backed and effectively gold only currency regime. Mentioned above, money creation is a happy process to all (except when it is collapsing), and often a useful one too.

If things will get so shockingly bad that this will not be enough to instill trust and confidence, the SDR basket may require a fraction of physical gold content. This may then have the appearance of a gold-backed money to most people like the strict, sure-fire solution, with a more subtle twist. The gold content requirement, will indeed hard-limit the reserve and money creation and bestow confidence. But with mutual agreement, the gold proportion can be more easily or very slowly relaxed, slowly and subtly diluting the SDR. Or, if China wants the money aggregate to expand, it can go ahead and post some of its gold. Its acquisition cost is cheap, below $1250 as we speak, well less than 1/10 of its future price when this will be needed. And China has been allowed to have plenty and plenty of this by the willing international community at the average pace of some 40 tonnes a week, every single week and for years on end.

Wiping out creditors by inflation is the easy part. Re-establishing money to restart the world economy is the harder one.

Remember:

“Whoever has the gold makes the rules." – Wizard of Id, May 3, 1965 (a comic strip)

“Possession is 9/10 of the law"- adage / lawyer joke.

This guest post is written by LK in Hong Kong

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen