LBMA’s Gold Shortage Exposed: Spreads Widen as Paper Market Crumbles

Unprecedented Spreads Between Spot and Futures Prices in Gold and Silver

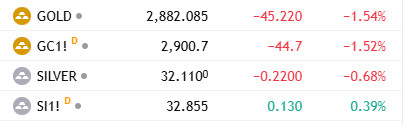

Over the past few weeks, financial markets have experienced an unprecedented widening of spreads between spot and futures prices for both gold and silver.

Traditionally narrow, these spreads have expanded to as much as USD $60 for gold and over USD $1 for silver. This significant discrepancy has created unique arbitrage opportunities, prompting substantial flows of physical metals from London to New York, as traders capitalize on lower spot prices in London and higher futures prices in New York.

As of the time of writing, the spread has narrowed slightly, with a USD 18.615 difference (0.65%) between spot gold (“GOLD") and gold futures (“GC1!"). For silver, the spread stands at USD 0.745, equivalent to 2.27%.

Despite clear arbitrage potential, these spreads have not normalized as quickly as would be anticipated by an efficient market, suggesting underlying market failures beyond simple arbitrage opportunities.

LBMA Bullion Bank Cartel

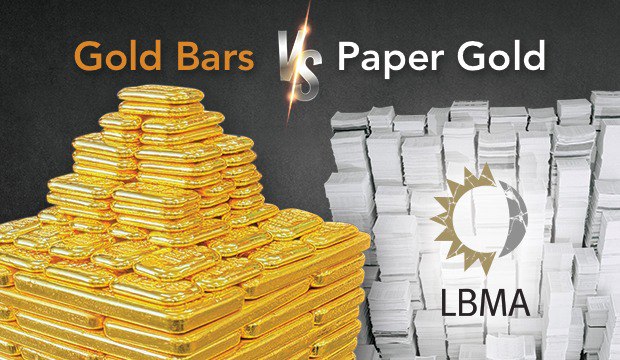

The LBMA cartel of bullion banks has historically controlled the London OTC spot price for gold, operating within a system that prioritizes the interests of bullion banks over the actual physical gold and silver market. Opacity is the name of the game here.

The LBMA lacks transparency, providing no public access to order book volumes or trading data. As a result, trading practices remain hidden from scrutiny. In essence, so-called spot gold is treated more like a currency, with little to no physical metal backing. Notably, the LBMA itself holds no gold reserves, instead relying on its member banks to maintain stockpiles.

BullionStar has been a long time critic of the LBMA where we repeatedly have been highlighting the lack of transparency, misleading data, and prioritization of paper trading over physical bullion. The LBMA has for a long time misrepresented vault stock levels creating a false sense of security about available metals.

Furthermore, LBMA enables the proliferation of unallocated synthetic paper gold, allowing bullion banks to trade so-called gold and silver without actual physical backing, which distorts true price discovery.

Controlled by bullion banks, the LBMA prioritizes their interests over individual savers and physical metal investors, favoring financial institutions while undermining the integrity of the bullion market.

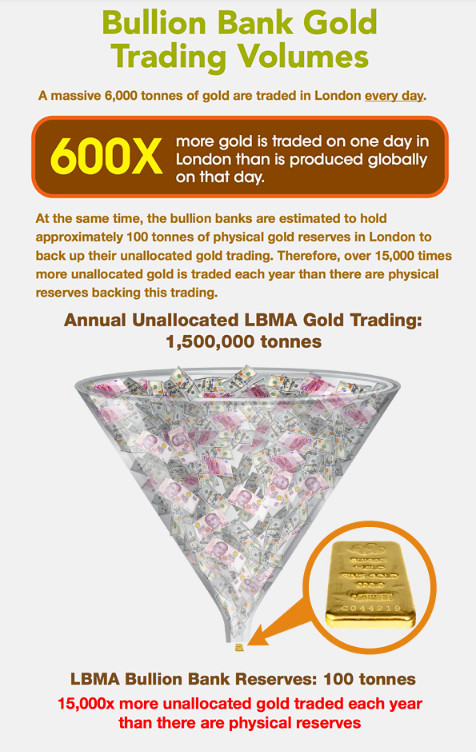

See this BullionStar infographic on The London Gold Market

Paper Metal vs. Physical Metal

As many are aware, there is a significant disconnect between paper and physical gold and silver markets. Estimates suggest that for every ounce of physical metal, between 100 and 600 times more paper gold and silver are traded. Our infographic from 2021 estimate paper silver to physical silver at 243:1. A recent analysis even places this ratio at 408:1, highlighting the sheer scale of this imbalance.

For years, the LBMA and COMEX have maintained the illusion that paper metal could be redeemed for physical metal. But with the U.S. increasingly pulling physical supply off the market, the paper-based system is facing mounting pressure. If just a small amount of paper metal holders start demanding physical delivery, the entire structure of the paper markets will collapse.

LBMA Collusion Coming to an End

The LBMA has historically relied on U.S. financial institutions to help manage any issues. For gold liquidity, swaps and leasing arrangements have been used to prevent vault runs. However, with the U.S. institutions now prioritizing gold repatriation and hoarding over supporting international markets, the LBMA has lost a key backstop.

This shift leaves LBMA bullion banks more vulnerable to physical shortages, increasing counterparty risk and undermining confidence in unallocated gold. Without U.S. support, bullion banks may resort to delaying settlements, widening spreads, or restricting redemptions—further exposing the paper gold system.

LBMA is Simply Out of Gold

London’s gold clearing banks—JP Morgan, HSBC, UBS, and ICBC Standard—have depleted their available physical gold for delivery and are now heavily relying on gold lending at the Bank of England. However, these borrowing avenues also appear exhausted.

As a result, these banks face a liquidity crunch in their loco London gold holdings, increasing counterparty risk among LBMA bullion banks that trade unallocated “gold credit.” The inability to access sufficient physical gold has led to paper gold claims trading at a discount, reflecting the growing difficulty in converting them into actual metal.

See this BullionStar infographic for information on Bullion Banking Mechanics.

“Gold is Heavy" & Shortage of “Guys with Vans" & “Ocean of Silver"

The LBMA has, as they always do, downplayed these developments, attributing the high spread and delivery delays to potential new tariffs rather than to any structural issues or shortages. They’ve stated that the 4-8 weeks lag times for gold deliveries fron London vaults are due to logistical challenges.

LBMA appears to recently have discovered that gold is heavy and that it needs “guys with vans" i.e. manpower and transportation resources to move gold. Perhaps they never realised before that gold was heavy as the vaults were empty anyway? But there’s certainly no lack of supply if you are to trust the LBMA (Reuters on LBMA’s stance). Regarding silver, the LBMA claims there’s an ocean of physical silver with no shortage whatsoever. However, the reality on the ground tells a different story.

This is all happening against a backdrop of highly elevated and sustained demand by Eastern countries including China, India and Eastern European countries which have quietly been vaccuming up all physical gold available yet stopping short of causing acute shortages.

Convicted Gold Manipulators Run LBMA

The LBMA positions itself as the global authority on precious metals, but its actions suggest it primarily serves the interests of its bullion bank members. While it claims to promote transparency, its reporting is delayed, aggregated, and carefully controlled—offering little real insight into the gold market’s true state.

Far from being an impartial regulator, the LBMA is dominated by major bullion banks like JP Morgan, which, despite being a convicted gold price manipulator, continues to hold influence.

The appointment of JP Morgan’s former head of precious metals, Michael Nowak, to the LBMA board while he was under investigation for market rigging exemplifies the association’s deep-rooted conflicts of interest. Rather than upholding integrity, the LBMA appears to function as a protective shield for the very institutions that distort and manipulate the gold market.

BullionStar’s Perspective on Physical vs. Paper Markets

At BullionStar, we observe that most market participants for now continue to base their pricing on spot prices, albeit with surcharges in some cases. If the LBMA is exposed as being out of metal and ultimately defaults – something we are already witnessing in a minor form through delivery lags – we anticipate that price discovery will shift from London spot to the futures market, provided that COMEX can facilitate actual physical deliveries rather than just warehouse receipts.

This remains uncertain. COMEX is not designed for large-scale physical withdrawals, as 99.96% or more of contracts are typically cash-settled. Whether unencumbered physical metal can be extracted from COMEX in significant quantities is uncertain.

As market participants come to realize that these markets are largely paper-based or semi-paper-based with minimal physical backing, there could be a scramble to secure physical metal.

If that happens, the price of gold and silver would likely be determined by true physical markets. In such a scenario, it is reasonable to expect that the equilibrium price would be multiple times higher, given the preposterous ratio of paper metals to physical metals.

The trend is clear. Physical liquidity of real gold and silver is rapidly draining from London and the LBMA.

As a result, Singapore, being the world’s best jurisdiction for buying and storing gold, is emerging as a leading hub for wealthy savers and investors to hold their physical bullion holdings.

Price Discovery Shifting from Paper to Physical Markets

With London’s vaults running dry and COMEX struggling to fulfill physical deliveries, the question arises: who will step in to fill the void? The answer is that a major physical gold exchange has already emerged, building substantial infrastructure and trading volumes over the past decade – the Shanghai Gold Exchange (SGE). In 2024 alone, the SGE saw an impressive 67.25% of traded gold, or 1,455 metric tons, delivered.

However, since access to the SGE is largely restricted for non-Chinese entities, a significant gap remains for a physical gold market in the West. This shift in price discovery underscores the urgent need for more physically settled markets outside of China.

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

The U.S. Dollar’s Decline: Why Precious Metals Matter More Than Ever

The U.S. Dollar’s Decline: Why Precious Metals Matter More Than Ever

Secure Gold Storage in Singapore: Inside BullionStar’s Premier Vault Facility

Secure Gold Storage in Singapore: Inside BullionStar’s Premier Vault Facility

Is Costco Gold a Good Deal? What You Need to Know Before You Buy

Is Costco Gold a Good Deal? What You Need to Know Before You Buy

Bitcoin Slows, Gold Glows: What’s Driving the Shift in 2025?

Bitcoin Slows, Gold Glows: What’s Driving the Shift in 2025?

Fort Knox Gold: A Historic Opportunity for Transparency in America’s Most Famous Vault

Fort Knox Gold: A Historic Opportunity for Transparency in America’s Most Famous Vault

BullionStar

BullionStar 0 Comments

0 Comments