LBMA Offered to Censor BullionStar

“LBMA ensures the highest levels of leadership, integrity and transparency for the global precious metals industry by advancing standards and developing market solutions."

– LBMA Mission Statement

When BullionStar repeatedly called on the LBMA to uphold its own mission – reforming for integrity and tranparency in the precious metals market – how do you think LBMA responded?

Did LBMA commit to clearer reporting of unencumbered gold? Did LBMA commit to end the price manipulation?

No, instead LBMA sent an operative and his secretary to BullionStar’s Bullion Retail Center in Singapore to inform us that there are inaccuracies in our coverage. The secretary’s assigned task, we were told, was to read our blog posts as soon as published!

However, they kindly suggested a solution – if we sent our blog posts to the LBMA for review before publishing, they could ‘correct’ any inaccuracies for us!

We rejected LBMA’s offer to censor us.

BullionStar’s Critique of the LBMA

At BullionStar, we take pride in our independence and have been exposing the LBMA’s practices for years. My colleague Ronan Manly has written extensively on their opaque operations, conflicts of interest, and market manipulation. The more we examine the structure of the gold market, the more evident it becomes that the LBMA is an obstacle to free and fair trading.

The LBMA positions itself as the global authority on gold and silver trading but overwhelmingly favors bullion banks and paper-based trading over physical metals.

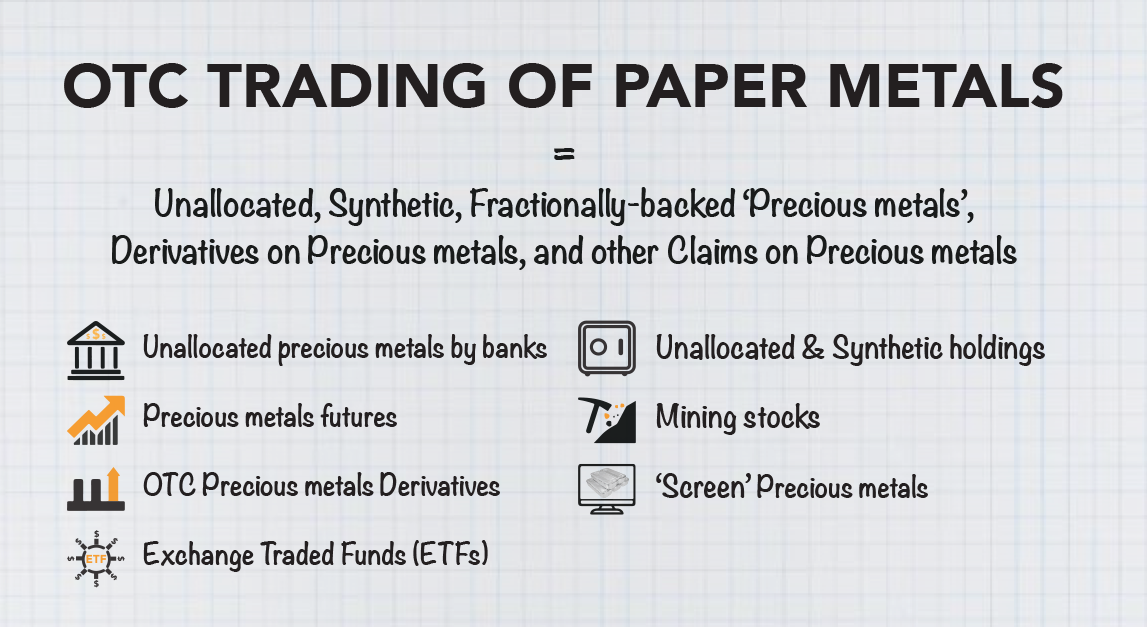

At the heart of the issue is price discovery. Rather than being driven by supply and demand for actual physical gold and silver, prices are influenced by opaque OTC trading of paper metals. This distorts physical market realities and creates opportunities for financial institutions to manipulate prices, sidelining physical investors and businesses.

Tied closely to bullion banks and the Bank of England, the LBMA maintains an opaque system that benefits large players while physical investors face limited transparency and fairness.

Since physical metals inherit prices from the OTC market, real gold and silver holders lose by having the price of their metals suppressed.

The Paper Gold Shell Game

LBMA oversees the paper gold and silver market – an elaborate system of unallocated accounts and derivatives that give the illusion of liquidity while masking the fact that there is far less physical gold than their contracts represent.

This system enables the banks to expand the supply of “gold” far beyond the available physical supply, suppressing prices and protecting their fiat interests.

The entire system is built on the assumption that most traders will never take delivery, allowing the bullion banks to engage in fractional reserve gold trading with impunity.

Convicted Gold Manipulators Run the LBMA

In 2020, JP Morgan admitted wrongdoing and agreed to pay over $920 million to settle U.S. probes into its manipulation of precious metals. The scheme involved thousands of deceptive trades over an 8-year period. Several traders, including Gregg Smith and Michael Nowak (a former LBMA board member), were later convicted of fraud, price manipulation, and spoofing and sent to prison.

In 2020, JP Morgan admitted wrongdoing and agreed to pay over $920 million to settle U.S. probes into its manipulation of precious metals. The scheme involved thousands of deceptive trades over an 8-year period. Several traders, including Gregg Smith and Michael Nowak (a former LBMA board member), were later convicted of fraud, price manipulation, and spoofing and sent to prison.

Despite this, JP Morgan remains a key player in the LBMA, retaining its status as a market-making member and participant in the daily gold and silver price auctions.

How can an organisation claim to ensure the highest levels of integrity, transparency, and governance while having JP Morgan as one of its most influential members?

Market manipulation fines are treated as just another cost of doing business, and banks continue operating with the same privileges, ensuring that the cycle of manipulation persists.

Murky LBMA Vaults

While the LBMA releases monthly data on total metal stored in London vaults, these figures mask critical details. How much of this is truly unencumbered, free-floating metal available for market use? The LBMA won’t say.

Much of the vaulted gold is tied up – custodied by the Bank of England for central banks or backing ETFs like SPDR Gold Trust leaving only a fraction as available for trade or purchase. BullionStar has previously estimated that the free float of London gold, excluding ETF holdings, is at most 800 tonnes – 1,200 tonnes. This estimate excludes private holdings, such as those held by bullion banks and other entities, further reducing the available supply.

Much of the vaulted gold is tied up – custodied by the Bank of England for central banks or backing ETFs like SPDR Gold Trust leaving only a fraction as available for trade or purchase. BullionStar has previously estimated that the free float of London gold, excluding ETF holdings, is at most 800 tonnes – 1,200 tonnes. This estimate excludes private holdings, such as those held by bullion banks and other entities, further reducing the available supply.

With 500 tonnes of gold already moved from London to New York in the past couple of months—and more on the way—it’s obvious that the LBMA is running out of physical gold. But rather than admitting it, what’s their excuse? A shortage of men and vans to transport it… because gold is heavy.

LBMA & COMEX Collusion Break Ranks

For years, the LBMA and COMEX have worked together to shore up the gold market during crises, scrambling to secure enough physical gold to maintain confidence in the paper trade. This was evident in 2020-2021, when panic nearly broke the system, yet they managed to hold it together.

Now the tide is turning. The U.S. seems increasingly uninterested about protecting the LBMA showing little concern for the widening gap between spot and futures prices or the spot price’s fading relevance as a benchmark for physical gold.

The focus has shifted to a desperate race to own physical gold before the inevitable paper market collapse.

Central banks, institutions and wealthy investors are amassing real physical bullion, signaling distrust in the LBMA paper markets. The once dominant LBMA is losing influence as tangible gold overtakes paper promises as the true measure of wealth and influence.

Is the LBMA Coming to an End?

LBMA member banks are not in the business of contributing to real price discovery for precious metals. On the contrary, the temptation to manipulate prices through spoofing and other tactics—driving volume and activity for profit—is too great to resist. With a keystroke, they can expand unallocated positions, effectively injecting “unlimited credit” into the system.

But this giant Ponzi scheme is coming to an end as more wealthy nations and individuals wake up to the truth – the self-proclaimed LBMA emperor has no clothes. There isn’t enough gold to back up even a fraction of the paper promises and the run on physical gold has begun.

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

The U.S. Dollar’s Decline: Why Precious Metals Matter More Than Ever

The U.S. Dollar’s Decline: Why Precious Metals Matter More Than Ever

Secure Gold Storage in Singapore: Inside BullionStar’s Premier Vault Facility

Secure Gold Storage in Singapore: Inside BullionStar’s Premier Vault Facility

Is Costco Gold a Good Deal? What You Need to Know Before You Buy

Is Costco Gold a Good Deal? What You Need to Know Before You Buy

Bitcoin Slows, Gold Glows: What’s Driving the Shift in 2025?

Bitcoin Slows, Gold Glows: What’s Driving the Shift in 2025?

Fort Knox Gold: A Historic Opportunity for Transparency in America’s Most Famous Vault

Fort Knox Gold: A Historic Opportunity for Transparency in America’s Most Famous Vault

BullionStar

BullionStar 0 Comments

0 Comments