Gold vs. Bitcoin: Bridging the Divide in 2025

For more than 5,000 years, gold has stood as the ultimate symbol of wealth and stability. From ancient Egyptian tombs to modern central bank vaults, its scarcity, durability, and universal recognition have made it a cornerstone of wealth preservation, particularly in uncertain times.

Fast forward to the 21st century, and a challenger has emerged: Bitcoin. In just over a decade, Bitcoin has risen from an obscure digital experiment to a global financial phenomenon, often heralded as the “digital gold" of the modern era. With its finite supply of 21 million coins, decentralized framework, and ability to operate outside traditional financial systems, Bitcoin has gained traction – especially in times of monetary instability.

The debate between gold and Bitcoin as the ultimate wealth protector has never been more relevant than in 2025. The world is grappling with persistent inflation, rising geopolitical tensions, and a shift toward digital-first economies. Investors are forced to confront critical questions: Should you rely on the timeless security of gold, or place your faith in the innovation and potential of Bitcoin? Which asset will best protect your wealth against the storms of economic uncertainty?

Rather than pitting these two assets against each other, this blog post explores how gold and Bitcoin serve distinct purposes. We’ll delve into their unique value propositions and show how they can complement each other in today’s investment landscape. Furthermore, we’ll highlight how BullionStar is able to facilitate seamless trading between gold and Bitcoin, empowering investors to leverage the strengths of both.

By understanding these two assets and their use cases, you’ll see why building bridges between traditional and digital assets is not just practical but also highly strategic in 2025.

Gold: The Timeless Protector

Gold has stood the test of time as the ultimate store of value, earning its reputation over 5,000 years as a symbol of stability, wealth, and power. Its scarcity, universal recognition, and resilience have made it a go-to asset for investors, governments, and civilizations during periods of uncertainty. While economies and fiat currencies have crumbled, gold’s value has persisted – Solidifying its role as a proven hedge against financial instability, including in 2025.

1. Gold’s Legacy Across Civilizations

Gold’s role as a store of value began as early as 4,000 BCE with the ancient Egyptians, who used it as a form of currency and a symbol of divinity. By the time of the Roman Empire, gold had evolved into the backbone of global trade and commerce. Throughout history, various civilizations have accumulated gold to demonstrate wealth and power. This practice persists, with modern central banks holding substantial gold reserves. Today, central banks around the world collectively hold over 35,000 metric tons of gold in their reserves, valued at over $3 trillion.

Notably:

- The United States holds the largest reserves at over 8,000 metric tons

- Germany ranks second with over 3,000 metric tons, followed by Italy and France, each with more than 2,400 metric tons.

- Emerging economies such as China and Russia have been steadily increasing their gold holdings. China, for example, added over 200 metric tons to its reserves in 2023 alone, bringing its total to more than 2,000 metric tons.

This widespread reliance on gold by both developed and emerging economies underscores its enduring importance in the global financial system.

2. Stability and Tangibility in a Digital Age

Gold’s intrinsic value comes from its physical properties: it is rare, durable, and cannot be artificially created. Unlike digital assets such as Bitcoin, gold’s tangibility provides investors with a unique sense of security. You can hold it, store it, and trade it globally without relying on technology or internet access.

Gold has also proven to be a stable store of value over the long term. While short-term fluctuations occur, its historical price trends demonstrate consistent growth:

- 1971: When the U.S. abandoned the gold standard, gold was priced at $35 per ounce.

- 1980: Amid high inflation and geopolitical tensions, gold surged to $850 per ounce.

- 2008: During the financial crisis, gold rose nearly 25%, reaching $870 per ounce, as stock markets collapsed.

- 2020: Amid the COVID-19 pandemic, gold hit an all-time high of $2,075 per ounce, reaffirming its safe-haven status.

- 2025: As of early 2025, the price of gold is hovering around 2,793 USD per oz, hitting a new all-time-high, further solidifying it’s reputation as a stable store of value and growth over time.

3. A proven performer in Crises

Gold has a track record of outperforming other assets during times of economic turmoil. Its ability to retain value – and even appreciate – makes it a cornerstone for wealth protection. Consider these historical examples:

- The 1930s Great Depression : While the global economy contracted, gold prices remained stable under the gold standard, and its purchasing power increased as deflation set in.

- The 1970s Inflation Crisis: Gold prices skyrocketed by over 2,000% from $35 per ounce in 1971 to $850 per ounce in 1980, providing a reliable hedge as inflation soared to double digits.

- The 2008 Financial Crisis: Gold rose by about 25% in 2008, reaching $870 per ounce. Its major rally occurred post-crisis, peaking at $1,900 per ounce in 2011 as central banks pursued loose monetary policies.

- The 2020 COVID-19 Pandemic: Amid widespread uncertainty, gold rose by 36% between 2019 and its peak in 2020, outpacing most other asset classes.

These events highlight gold’s ability to thrive in conditions where other assets – such as stocks or fiat currencies – falter.

4. Central Banks’ Continued Confidence in Gold

Gold’s importance extends beyond individual investors; it is a critical part of the global financial system. Central banks collectively own over 17% of all above-ground gold, underscoring their trust in its value. In recent years, central banks have increased their gold holdings significantly:

- Since 2010, central banks have been net buyers of gold, purchasing an average of 450 metric tons per year.

- In 2022, central banks bought a record 1,136 metric tons, the highest level since 1967.

- This trend continues into 2025. Countries such as Turkey, India, and Brazil seek to diversify away from the U.S. dollar and safeguard against currency volatility.

Gold’s ability to act as a hedge against currency devaluation and geopolitical risks ensures its ongoing relevance in central bank strategies.

5. The Psychological Comfort of Gold

Gold is more than just an investment – it is a symbol of stability and prosperity. The tactile nature of gold, whether in the form of bars, coins, or jewelry, provides investors with a tangible sense of security that no digital asset can replicate. In an increasingly digital world, where assets exist as mere entries on a screen, gold offers peace of mind as a physical, enduring asset.

Even during times of extreme market volatility, the sight of gold in a safe deposit box or vault reassures investors, reinforcing its role as a psychological anchor in uncertain times.

Gold’s Enduring Relevance

For over five millennia, gold has preserved wealth through wars, recessions, and inflationary periods. In 2025, as the global economy faces growing uncertainty, gold continues to shine as a beacon of stability. Its proven track record, institutional backing, and psychological reassurance make it the ultimate choice for those seeking a reliable store of value. While Bitcoin may offer speculative opportunities, gold’s enduring legacy cements its status as the ultimate wealth protector.

Bitcoin: The Digital Innovator

Bitcoin has revolutionized the concept of money and value in our digitized world. In just over a decade, it has evolved into a viable asset class for tech-savvy and forward-looking investors.

1. Decentralization and Scarcity

Bitcoin’s supply is capped at 21 million coins, mimicking gold’s scarcity. Its decentralized framework allows users to transact without intermediaries, appealing to those seeking financial autonomy.

2. High Growth Potential

Bitcoin’s price trajectory has been meteoric, albeit volatile. From less than $1 in 2009 to over $100,000 in 2025, it has delivered substantial returns for early adopters and continues to attract speculative interest.

3. A New-Age Inflation Hedge

Bitcoin’s fixed supply positions it as a potential hedge against inflation. However, its short history makes its effectiveness in this role less certain compared to gold’s centuries-long track record.

Bridging Gold and Bitcoin: A Holistic Approach

While gold and Bitcoin may seem like opposites, they are more complementary than competitive. Both assets have unique strengths that cater to different investment goals:

- Gold offers stability, tangibility, and a proven track record during economic downturns.

- Bitcoin provides high growth potential, technological innovation, and decentralized financial freedom.

Practical Tips for Investing in Gold

In May 2014, BullionStar became one of the first bullion dealers globally to facilitate seamless trading between gold and Bitcoin, offering investors the ability to diversify effortlessly.

Investing in gold is one of the most reliable ways to protect and grow wealth, particularly in uncertain economic times. Whether you’re a seasoned investor or just starting, it’s important to choose the right investment approach and work with a trusted provider to ensure the safety, authenticity, and convenience of your gold holdings. Here’s a guide to getting started, featuring products and services from BullionStar, a leading name in the gold investment industry.

1. Choose the Right Form of Gold Investment

Gold comes in various forms, each with unique advantages depending on your investment goals. BullionStar offers a wide range of options to suit different needs:

- Gold Bars: For investors who prioritize maximizing value, gold bars are an excellent choice due to their lower premiums over the spot price. BullionStar offers a variety of gold bars in different sizes, from 1 gram bars for entry-level investors to 1-kilogram bars for those making larger purchases.

- Gold Coins: Gold coins combine value with historical and aesthetic appeal. BullionStar stocks an extensive selection of globally recognized coins, such as the United Kingdom Gold Britannia, Canadian Gold Maple Leaf, and Austrian Philharmonic. These coins are highly liquid and widely accepted worldwide.

- Gold Jewellery: For those who want to combine investment with practicality, BullionStar also offers investment-grade gold jewelry as well as refurbished pre-loved jewellery, which retains value while serving as a wearable asset.

- Bullion Savings Program: BullionStar offers a bullion savings program, where you can purchase precious metals in as little as 1 Gram! They can be converted into physical bullion bars at any time.

- No-Spread Gold and Silver Bars: BullionStar industry leading No-Spread Gold and Silver Bars is also another avenue where you can buy Gold or Silver at No Spread!

2. Prioritize Secure Storage

Storing physical gold safely is essential. BullionStar provides a state-of-the-art vault storage solution located in Singapore, New Zealand and the United States. Here’s why it’s a great choice:

- Fully Allocated Storage: Your gold is stored separately under your name, ensuring you retain full ownership.

- Competitive Storage Fees: BullionStar offers competitive storage fees among bullion dealers.

- 24/7 Access: You can access your account online anytime to view your holdings or request physical delivery.

- No Sales Tax: This makes purchase and storing precious metals a cost-effective exercise.

For those who prefer to store gold at home or at your own safe deposit box, BullionStar also offers discreet packaging and fully insured delivery services.

3. Timing Your Gold Purchases

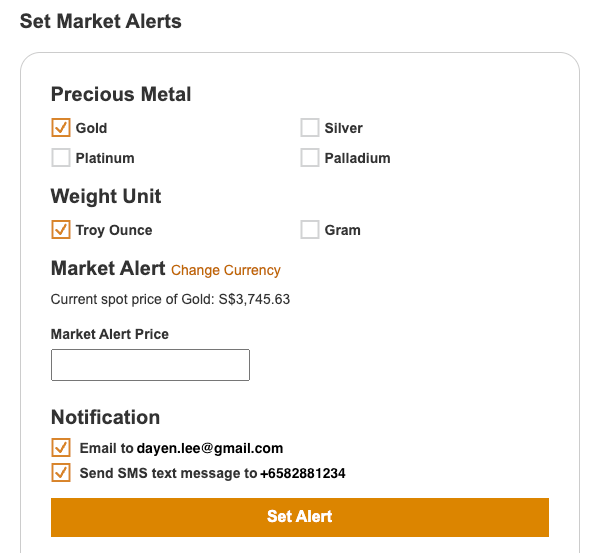

While gold is best viewed as a long-term investment, buying during price dips can help maximize returns. BullionStar’s live spot price charts and market insights make it easy to monitor gold prices and make informed decisions. They also offer Price Alerts. Set alerts to notify you when gold reaches your desired price point.

4. Diversify Your Gold Portfolio

Diversification within gold investments can reduce risk and increase liquidity. Consider holding a mix of: Bars for bulk value, Coins for liquidity & Bullion Savings Program.

BullionStar’s wide product range ensures you can build a balanced portfolio with ease.

Conclusion

In 2025, Gold and Bitcoin are not adversaries but allies in wealth preservation and growth. Gold’s timeless stability and Bitcoin’s innovative potential make them powerful tools when used together. By embracing platforms that enable seamless trading between these assets, investors can enjoy the best of both worlds.

So, whether you’re a gold enthusiast, a crypto believer, or somewhere in between, the future of wealth protection lies in balance and adaptability. Why choose one when you can harness the strengths of both?

Let us know: How are you integrating gold and Bitcoin into your investment strategy? Share your thoughts below!

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Is It Too Late to Buy Gold in 2025? 7 Signs Pointing to Gold’s Next Major Rally

Is It Too Late to Buy Gold in 2025? 7 Signs Pointing to Gold’s Next Major Rally

Silver’s Coming Breakout: Expert Insights from Peter Krauth

Silver’s Coming Breakout: Expert Insights from Peter Krauth

The Golden Truth: How Financial Advisors’ Silence on Bullion Could Cost You Your Wealth

The Golden Truth: How Financial Advisors’ Silence on Bullion Could Cost You Your Wealth

US Announces New Tariffs: What It Means for Your Wealth and Why Gold Still Wins

US Announces New Tariffs: What It Means for Your Wealth and Why Gold Still Wins

The U.S. Dollar’s Decline: Why Precious Metals Matter More Than Ever

The U.S. Dollar’s Decline: Why Precious Metals Matter More Than Ever

BullionStar

BullionStar 0 Comments

0 Comments